© BMR, Inc. dba Spader Business Management. All rights reserved.

What a year it’s been. A few months ago the stock market was at a record high, and many of our clients were ready for another prosperous year.

It goes without saying all that has changed. Even if your market area is relatively unaffected by the COVID-19 virus itself, the stock market losses and other economic disruptions will, at some point, seriously impact every market area in the United States and Canada.

Since my father started this business over 40 years ago, we have developed strong relationships with many of you, sharing the highs and lows as business partners and friends. Unfortunately, most businesses will be faced with tough choices, and we’re asking ourselves, “What can we do right now?”

We are seeing, broadly speaking, two extremes, with many points in between. For some of you, flush with solid “war chests” built up over the years, this new reality will mean enduring losses while you keep your team together, readying for a market rebound. For many, though, the prospect of 30, 60, or even 90 days with significantly-reduced (or no) revenue isn’t just an inconvenience. It could spell the end of a business built on years of hard work and sacrifice.

Which category are you in?

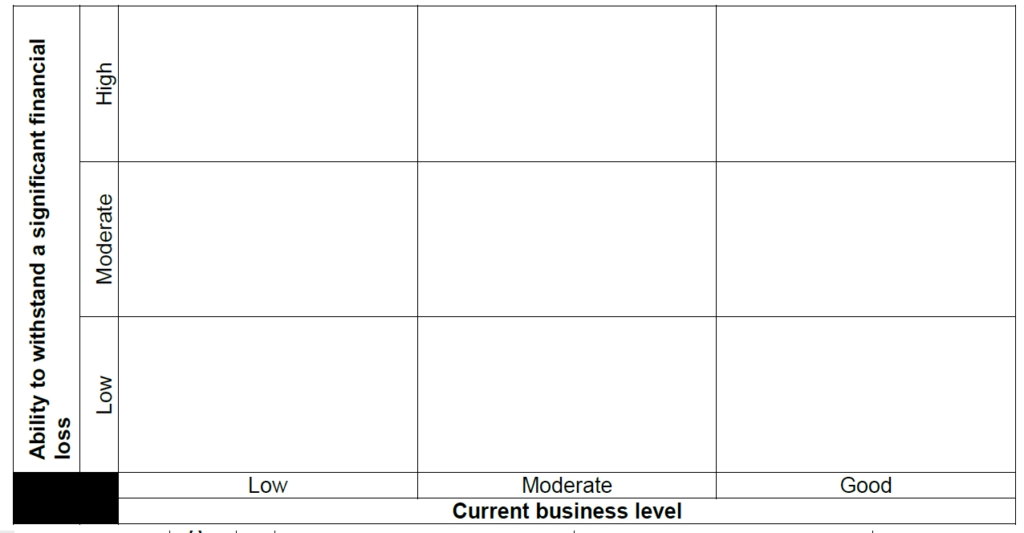

This Business Situation Analysis has been created to help any business sort through the noise and get to those key questions and actions that are needed to make sound business decisions now. In addition to the situation analysis, for those in the “Low-Low” or “Low-Moderate” segments there is a list of nine recommended actions.

We share with you the sudden and extreme dislocation the COVID-19 crisis has meant for many of your businesses and your families. We send our prayers and best wishes to you and your team, and hope these tools are of value.

Dedicated to your fulfilling success,

John Spader and the Spader Business Management Team

Business Situation Analysis

Directions: Plot your current state based on levels of revenue and your ability to withstand a significant financial loss. Please contact us if you want help assessing your situation.

At the end of this list are some alternative questions to start with if you are in a “high” ability position.

Low-Low or Low-Moderate? | 9 Action Items for Stabilizing and Shaping Your Future

If your business situation analysis result is low-low or low-moderate, the speed with which you respond can affect your survival. Work on these in this order. Refer to the following page for more specific actions and recommended tools for several of these steps.

Stabilize Your Current Situation Now

- Take control of cash; make sure it doesn’t get any worse; stop all spending without approval by appropriate leadership

- Assess the situation using facts; seek reliable sources (internal and external) about what is going on and what is possible

- Watch your attitude; and that of the people; conduct a “check-up from the neck up” for you and your key people

- Stop the losses; figure out what you need to do so you don’t lose any more money; or at least get the losses to manageable levels

Shape Your Future Direction Now

- Find the positives; look for incremental business opportunities, building blocks

- Make a recovery plan; how can you make this business work?

- Raise more cash; identify situations and decisions to generate cash

- Strengthen credibility (with customers, lenders, vendors, staff, etc.); share your plan, maintain and build credibility

- Show a profit; identify the path to profitability, or make a plan to downsize or even exit the business

Tools and Specific Actions

Stabilize Your Current Situation Now

- Take control of cash; make sure it doesn’t get any worse; stop all spending without approval by appropriate leadership.

- Cut off all purchases without top-level approval (except pre-sold orders).

- Get a best-case/worst-case weekly, 30- and 60-day cash flow plan in place and review it daily to make key adjustments.

- See also #7.

- *TOOLS: SBM True® Cash Flow Reports, Cash Flow Worksheet from Total Management 1 workshop

- Assess the situation using facts; seek reliable sources (internal and external) about what is going on and what is possible.

- If you are in the Low-Low situation, do you truly have a viable business, or do you need to minimize losses and get out?

- What are the odds of getting back to profitability, how long will it take, and are you as the leader truly ready to do it?

- Watch your attitude; and that of the people; conduct a “check-up from the neck up” for you and your key people.

- Culture – do your people clearly know what you stand for, and what the performance expectation and the vision for the business is? Or is it every person for themselves? Who is/is not “on the team?” Those who are draining energy must change now, or leave.

- Leaders lead, and this is not the time to shrink from the duty; if you have taken a step back from the day to day – take a big step back into it: See and be seen … take personal accountability for the business again; let your demonstrated commitment and winning approach to the challenge ahead set the tone for others to replicate.

- *TOOLS: Attitude as a Leader Assessment, Company Personnel Performance Survey (if not a 3, 4 or 5 on this assessment, they are a question; what do the 3s need to do to become a 4 or 5 ASAP in key areas?), Top Work Priorities worksheet

- Stop the losses; figure out what you need to do so you don’t lose any more money; or at least get the losses to manageable levels.

- Reduce payroll; find yourself on the Spader Business Plateaus map … right now, and right-size to the top of a plateau.

- Maximize every sales opportunity that exists; are all your sales processes being followed every time?

- *TOOLS: Business Plateaus Maps from Total Management 1 & Personnel-Based Budget spreadsheet

- Find the positives; look for incremental business opportunities, building blocks. .

- Make a plan; how can you make this business work?

- Create Profit/Loss and Cash Flow plans for the range of key scenarios (most likely, worst-case, best-case)

- You may need to get out your Spader Total Management 1 worksheets and lay it out … how are you going to be a sustainable business with 20, 30, 40, 70% less volume?

- TOOL: Personnel-Based Budget spreadsheet, Profit Planner application

- Raise more cash; identify situations and decisions to generate cash.

- Borrow where you have capacity and it makes sense (you never know when operating and flooring lines may be frozen or cut; remember 2008-2009?)

- Turn inventory equity into cash – if it’s owned, it’s in prime condition.

- Strengthen credibility (with customers, lenders, vendors, staff, etc.); share your plan, maintain and build credibility.

- Proactively and openly communicate with all internal and external key stakeholders (employees, vendors/lenders, etc.)

- Tune in to your customer base … like when you were just starting out; communicate and connect with them, offer specials, create value for them as your customer; tune your website to promote your brand.

- Show a profit; identify the path to profitability, or make a plan to downsize or even exit the business.

*SPADER CLIENTS: If you want access to any of these tools, please visit the Spader Client Portal, or contact your facilitator / consultant or the Spader help desk and we’ll be happy to provide them, along with guidance for how to use these.

If you aren’t currently a Spader client but you have questions or would like help creating a detailed plan, please feel free to contact us:

info@spader.com ● 800.772.3377

Ability to Withstand = High? | Key Questions

From working through plans recently with clients who are starting from a stronger financial position, these high-levels questions can help clarify your thought process and result in an even more effective approach:

- In a worst-case scenario, how much are you willing to risk (spend) to keep your workforce intact? (e.g., if you have no revenue for two months, will you pay them regular wages?)

- Knowing this situation will eventually change (hopefully in the near future), how long would it take to build back a workforce like this, and what opportunities would be missed if you don’t keep the team intact?

- If the worst-case scenario unfolds, what are the metrics, events, time frames or levers that you will put in place to monitor and adjust your plans in a timely manner as needed?

© BMR, Inc. dba Spader Business Management. All rights reserved.