PowerSports Business, July 2023

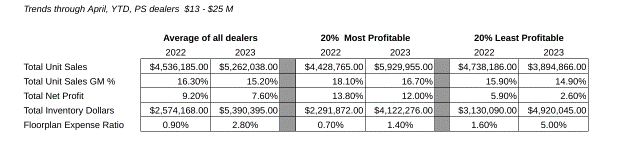

The good news is that, based on data reported to us, 2023 is looking like another strong year for powersports dealers. Margins and nets remain strong for most dealers, employee productivity is strong, and overall expenses are tracking close to 2022 numbers. By the basic income statement numbers, things are looking very positive for the majority of dealers! Compared to last year, the average-performing dealer (by net profit) is reporting a 7.6% net so far this year, while the top 20% is checking in with a very healthy 12.0%.

In all categories, though, we see a potentially-concerning trend developing; inventory levels are rising rapidly, resulting in slowing turns, and pointing to a future of increased carrying costs and declining margins. Our data indicates that dealers would be wise to return to the best practices of inventory management, making sure that inventory management becomes a regular topic at all management meetings.

How quickly things change! Seems like only yesterday dealers and manufacturers alike were scrambling for product, and everything that hit the lot had a willing buyer ready to take delivery. But dealer inventory levels have effectively doubled since this same time last year, and with more manufacturing capacity coming online soon, dealers can expect increased urgency from our manufacturing partners to maintain or expand buying programs.

The industry norm of interest reimbursement programs helps keep manufacturing normalized in off season months by reducing dealer carrying costs. Without question, these programs can be valuable for dealers as well, especially in a time of rising interest rates. But I. R. programs also mask the true cost of inventory … over-inventoried dealers often find a rude awakening as inventory comes off program and full interest charges and curtailments are due.

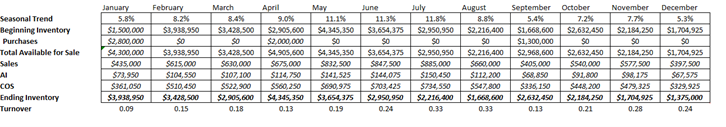

The answer is not complicated, but it’s also not easy. Dealers need to implement inventory management planning that gives them visibility into how much inventory they need, when they will sell it, and how much it will cost to keep it in stock. At first glance, this may seem impossible with the typical manufacturer ordering program, but it really isn’t. Consider the sales and inventory plan below, based on annual sales of $7,500,000 for a product:

It all starts – like so many other things – with a great annual sales forecast. Starting from this number, we can determine our monthly sales objectives and Available Income (Gross Margin) goals using seasonal trends, and from there it’s a matter of plugging in purchases to determine monthly turnover.

In the example above, the dealer takes delivery of three major orders throughout the year, and while the inventory spikes as high as $4.3M in May, you can see that it tracks back down very nearly to the starting point by the end of the year. This example assumes flat gross margins throughout the year, but if the dealer noticed actual sales falling off of budget, they might decide to get more aggressive at some point in the season.

This is powerful information that could assist any dealer in their inventory planning process. The key is understanding that inventory management is more than just guesswork based on last year’s sales. It’s a methodical process that begins with a serious sales projection, and a thoughtful consideration of the timing and size of manufacturing ordering programs.

Inventory management is both an art and a science. This article only briefly touches on the subject. If you’d like to learn more, contact us at 800.772.3377 or www.spader.com.