RVBusiness March/April 2024

A frequently-heard comment from RV dealers is that 2023 was something of a reset year … a year of blowing out inventory to get rid of the excess product from the COVID boom. The theory was that we just need to clear out this product at any cost so that we can get back to “normal” margins. Whether the theory is correct or not is an open question. What is indisputable, however, is that many dealers saw a steep decline in profitability in 2023 due in large part to falling unit margins and increased carrying costs.

Certainly, many dealers entered 2022 with excess and aging inventory, and increasingly engaged in very aggressive pricing and marketing to deal with it. Compounding matters, many manufacturers had inventory issues of their own leading to discounting at the wholesale level, further disrupting the normal retail market.

The average RV dealer’s new unit inventory (by dollars) was 9.7% lower on January 1, 2024, compared to the January 1, 2023. That’s a relatively-modest decline considering that net profits were on average 67% lower in 2023 than they were in 2022. Still, it’s a decline … and assuming that in the mix of sales for the year much of the distressed inventory has been cleared out and replaced with better merchandise, maybe 2024 will be a year of rebounding margins and profitability.

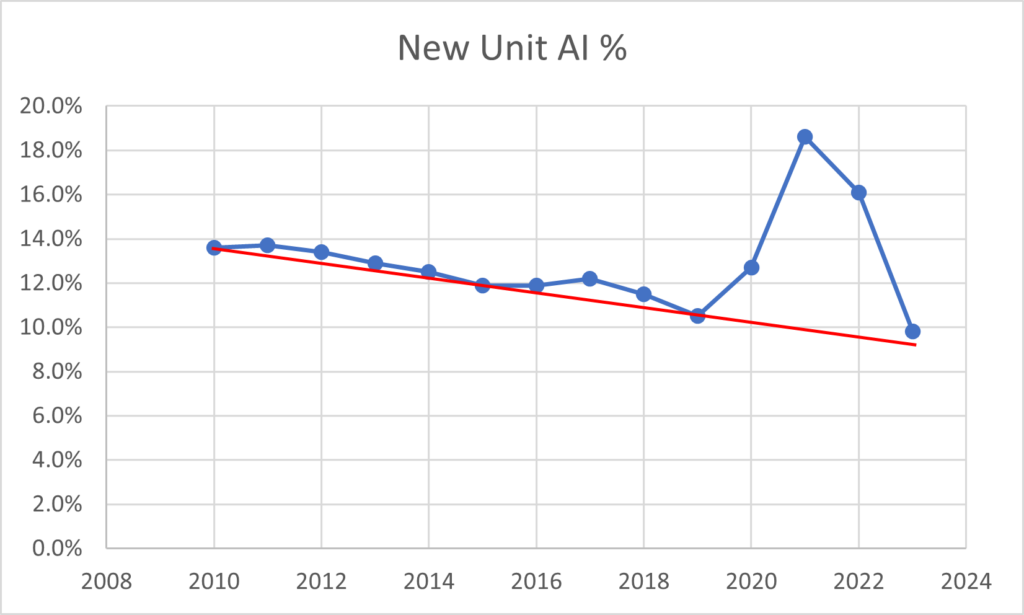

Or will it? Consider the chart below, a review of new unit margins from 2010 through 2023.

New Unit Sales Margins – Average of All Dealers

In addition to showing what a tremendous boost in margins the COVID years were, the graph also shows a fairly steady and continuing erosion of margins since 2010. The red line shows the trend … clearly moving in the wrong direction. If you ignore the COVID years, there is an inescapable movement toward lower unit margins. In this light, 2023 doesn’t seem like a reset year at all – it seems like the obvious continuation of a trend that has been in motion for more than a decade.

If true, what does this mean for dealers?

First, it means that dealers need to reinvest themselves in outstanding salesmanship. The rise of F&I has replaced much of the unit margin declines, but it has also led many dealers to effectively devalue the need for quality salesmanship. From 2020 to 2022, salespeople didn’t have to sell – they just had to take orders. And in 2023, while they may have been technically selling, many if not most dealers relied on minimum and flat commissions as their main compensation programs, as salespeople couldn’t seem to make enough gross to maintain their incomes. So, it has been four years since the normal sales routine – great demonstrations and professional closing skills leading to higher sales margins – has been in effect at many dealerships. 2024 is the year for dealers to rededicate themselves to quality sales processes, skill development, and sales management. If you want better margins than the national averages above, you’ll need above-average salespeople who can handle price objections and build value in buying from you.

Second, dealers need to continue to expand their aftermarket selling processes. It is not enough just to get the unit over the curb. The most profitable dealers are finding ways to add margin by systematically presenting customers with options to upgrade and customize their new unit, and integrating these up sales with the finance department so customers have options for payment. When you consider that labor is effectively 100% margin and accessories average 35% margin, it’s clear that this is a significant lift from the 9.8% average of new units.

Finally, the F&I department needs scrutiny. As margins have fallen, the benchmarking for F&I has consistently risen, and dealers need to continually strive for increased penetration and margins for all F&I products. A highly professional F&I department can average F&I gross margin dollars of 8.5% of unit sales, and we have many clients exceeding this. The average of all dealers in 2023 was 6.9%, so for many there is significant opportunity for improvement in F&I. For the average dealer, every 1% increase in this metric will lead to approximately $300,000 in Available Income (Gross Margin), much of which will flow right to the bottom line. It’s worth the effort.

There is much dealers can do to buck the trend of falling sales margins. Building a significantly-different retail experience, insisting on the highest caliber of salesmanship, and properly managing inventory will all help boost margins. At the end of the day, though, the overall trend seems fairly evident, and there is likely an upper limit on unit margins given the prevalence of price advertising. Dealers need to continue to develop and improve their aftermarket sales processes and develop cultures that truly support them.