RVBusiness November/December 2023

RV Dealer – please come to the principal’s office! You might be in trouble!

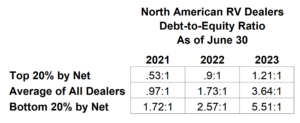

One look at the chart above will quickly tell in numbers what dealers around the U. S. and Canada have been experiencing every day at their dealerships. Sales volume and margins are declining, the average cost of inventory has increased dramatically, and the cost of carrying this inventory has seriously dented profitability for many. The result? For many, it has led to a dramatic erosion of their company’s Debt-to-Equity ratio, arguably the most important measure of a dealer’s financial health and ability to manage their floorplan debt.

Dealers across North America have started getting the phone calls and emails they never want to receive. Like being summoned to the principal’s office in school, being contacted by your lender to discuss your financial results and lending covenants can be a very uncomfortable experience. After all, for most dealers, the floorplan lending agreement effectively determines the current and future ability of the business to survive.

In terms of leverage ratios, lower is always better. Simply put, the Debt-to-Equity ratio is measuring how much of your lenders’ money is in the business, the total of all of your debt, versus your capital, expressed as equity. For most of the COVID market, when inventory was scarce and profits were high, dealers’ Debt-to-Equity ratios were in great shape. Historically, among other criteria, most lenders like to see dealers geared 4.0:1 or less. As the chart above shows, in June of 2021 even the least-profitable dealers were less than half of that! Fast forward two years, however, and the story has changed considerably.

This has become a challenging market for sure, and every business person should be concerned if they are missing important covenants in their lending agreements. But, there are actions you can and should take to prepare yourself for this sort of meeting and hopefully avoid it altogether.

First, understand your lending agreement and the covenants included in it. Often there will be specific ratios; Debt-to-Equity will almost certainly be included, but you also might find a Current Ratio guideline, some sort of minimum cash-on-deposit rule, and any number of other detailed requirements. Naturally, many of us glossed over these details when business was booming, but it’s critical to have a complete understanding of the lending agreement … and where each of these requirements lies on your income statement and balance sheet. Knowledge truly is power in this instance, because oftentimes deliberate and specific action on your part can significantly improve your metrics.

Second, be sure your financial statements are accurate. Dealers are busy people, and they are usually not oriented by nature to accounting and bookkeeping. But this is not the time to be releasing inaccurate financial results; there might not be a chance for a do-over later. Be sure that you have personally and carefully scrutinized the statements before they are sent to your lender. Compare your financials, and know if and where you might be outside of your lending agreements and by how much.

If you find yourself out-of-covenant, don’t panic. Develop a detailed, concrete action plan to get your results back into alignment with your agreements. If your Debt-to-Equity ratio has risen above 4.0:1, the most important action you can take is to reduce floorplanned inventory as quickly as possible, and plan carefully to maintain a lower level going forward. The other immediate cure is to put more capital in the company which, if possible, may also be warranted. However, before recapitalizing, dealers should carefully understand the factors that led to the higher ratios to begin with.

A key to understanding leverage ratios in the current environment is the acknowledgment that as inventory costs have increased, business equity must increase proportionately. The average RV dealer’s inventory levels (by dollars) has increased approximately 70% since January of 2020. If that’s the case for you, has your equity also increased by 70% over that time period?

Create a written game plan with proforma financial results that proves you have a complete understanding of the situation. Your plan should be very specific, including the inventory that will be sold, the manufacturers you will be representing in the future, the personnel changes that will be made, and, of course, the selling and cash flow forecasts going forward. Be prepared to share this with your lending partners, and don’t be afraid to approach them first.

Finally, take action on your plan immediately rather than waiting to be pressured by a lender. If you find that you are near or over the limits of your lending agreements, there is nothing to be gained by waiting deeper into the slow season before making changes. Executing a timely correction can help avoid a complete salvage operation in the future.

If you need any assistance interpreting your financial data or generating forward forecasting and planning, please contact us at 800.772.3377.