RVBusiness September/October 2023

As the selling season begins to wind down, wise dealers will take a hard look at their most important liquid asset – cash – and make sure they truly have the funds needed on hand to make it through the off-season without any emergencies.

In addition to a trying year in profitability, higher interest rates, and stubbornly high inventory levels, many dealers need to manage payment of substantial curtailments for the first time in years. With proper planning, though, many times cash flow crunches can be anticipated or even avoided.

Cash flow forecasting can be detailed work, and there are many levels of detail beyond what will be discussed in this article, but all dealers should have a basic forecast of their cash needs.

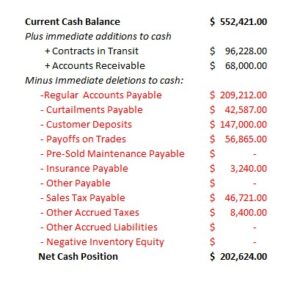

The first critical step in managing cash flow is to figure out how much cash you actually have. That sounds pretty straightforward, but if you have ever generated a net cash position statement for an RV dealership, you’ll know there is nothing straightforward about it at all! Dealerships are complicated. Between sales tax and titles, flooring, accounts payable, trade-ins, payroll, and customer deposits, it is easy to mistake your operating account balance for your true cash balance.

Consider the following:

If this dealer logged into the bank account, looked only at the top line balance, and then went back to work, he or she might make very different business decisions than if they considered the entire picture. All of this information is available in your DMS … the only question is whether or not you’re assembling a report like this on a regular basis.

Secondly, be sure to update your sales and expense forecast through the entire slow season. Many dealers budget through the calendar year-end only and create their new budget late in the current year. For the purposes of a cash flow forecast this is insufficient – you’ll need to connect January, February, March, and most likely April to your current forecast in order to adequately prepare for the slower months.

While profit and loss is not an exact proxy for cash flow, it is a very good place to start. At the minimum, you can project net operating losses, after adding back depreciation, as drains on cash, as well as planning for any needed capital improvements. A more detailed forecast might include available lines of credit, loan payments, and used flooring availability; but at minimum the updated P&L forecast is an absolute must.

Finally, assemble a curtailments forecast and keep it updated. This may be time-consuming at first, and it needs to be regularly updated as units get sold, but it will be an invaluable tool. Curtailments are balance sheet adjustments without visibility on the income statement, so they need to be manually projected. Many dealers are receiving unwelcome surprises every month with their flooring bill … don’t be one of them! You can and should create a 30-, 60-, 90-, and 120-day forecast of curtailments due, and factor this into your cash flow planning.

The time to ensure you have adequate funding for the off-season is right now. By projecting cash flow now, you’ll be able to plan your needs in advance and avoid an emergency in the wintertime. If possible and needed, consider arranging a used unit flooring line or other business line of credit.

Almost everything in business is negotiable, but lack of cash is not. Many cash flow crises can be anticipated and avoided with a little advance planning, so this is time well spent.